What Does Menopur Do in IVF? Your Guide to This Fertility Game-Changer

April 15, 2025

How Do They Retrieve Eggs for IVF?

April 15, 2025What Insurance Covers IVF in Alabama: Your Ultimate Guide to Fertility Coverage

What Insurance Covers IVF in Alabama: Your Ultimate Guide to Fertility Coverage

Navigating the world of fertility treatments can feel overwhelming, especially when you’re trying to figure out what insurance will—or won’t—cover in a state like Alabama. If you’re dreaming of starting a family through in vitro fertilization (IVF), you’re not alone. Thousands of couples and individuals face infertility every year, and IVF often becomes their beacon of hope. But here’s the catch: it’s expensive, and insurance coverage isn’t always straightforward. So, what insurance covers IVF in Alabama? Let’s dive into everything you need to know—plain and simple, with a sprinkle of insider tips and real-world advice to guide you.

Why Understanding IVF Coverage in Alabama Matters

IVF isn’t cheap. A single cycle can cost between $10,000 and $15,000, and that’s before you add in medications, testing, or extra procedures like genetic screening. For many, insurance is the key to making this dream a reality. But Alabama isn’t one of the states that mandates fertility coverage, which means you’re often left piecing together a puzzle of policies, exceptions, and creative solutions. Knowing what’s covered (and what’s not) can save you time, money, and a whole lot of stress.

The good news? You’ve got options. From employer-provided plans to out-of-state policies, there’s more to explore than you might think. Plus, recent changes—like Alabama’s response to a 2024 court ruling on embryos—have shifted the landscape, making this a hot topic worth digging into.

The Basics: Does Insurance Cover IVF in Alabama?

Alabama doesn’t have a state law requiring insurance companies to cover IVF or other fertility treatments. Unlike states like California or New Jersey, where mandates exist for certain plans, Alabama leaves it up to individual insurers and employers. That means coverage depends entirely on your specific insurance policy—and a little luck.

Most Alabama-based insurance plans, like those from Blue Cross Blue Shield of Alabama (BCBSAL), don’t cover IVF unless you’re part of a special group, like state employees under the PEEHIP plan (more on that later). However, if your insurance comes from out of state or through a large employer with a generous benefits package, you might have better luck. The trick is knowing where to look and what to ask.

What’s Typically Covered (and What’s Not)

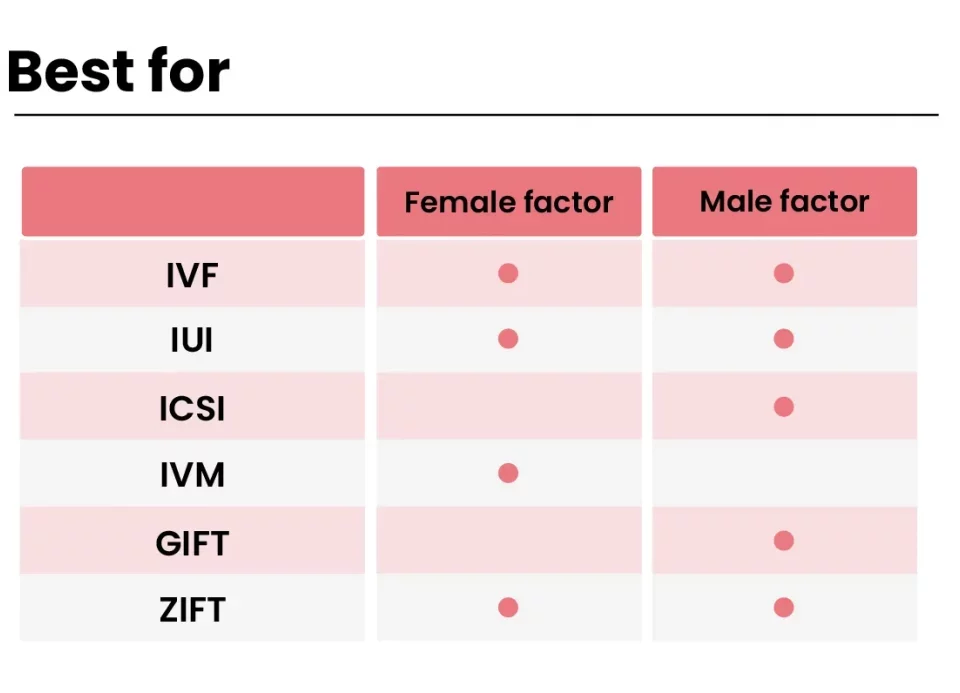

Even without a mandate, some parts of the fertility journey might still get a green light from your insurer. Here’s a quick breakdown:

✔️ Covered (Sometimes):

- Diagnostic tests (like blood work or semen analysis) to figure out why you’re struggling to conceive.

- Medications for conditions like endometriosis that might affect fertility.

- Basic treatments like intrauterine insemination (IUI), if your plan includes it.

❌ Not Covered (Usually):

- IVF itself, including egg retrieval, fertilization, and embryo transfer.

- Fertility drugs specific to IVF (think gonadotropins or progesterone shots).

- Extra procedures like embryo freezing or genetic testing.

Your best bet? Call your insurance provider and ask for a detailed rundown of your benefits. Don’t be shy—get specific about “infertility services” and “assisted reproductive technology.”

Spotlight on Alabama’s Biggest Insurer: Blue Cross Blue Shield

Blue Cross Blue Shield of Alabama is the big player in the state, covering a huge chunk of residents. So, what’s their deal with IVF? For most standard plans, IVF isn’t covered. You’ll see coverage for diagnostics—like hormone tests or ultrasounds—but when it comes to the big stuff (egg retrieval, lab fertilization), you’re usually on your own.

There’s an exception, though: the Public Education Employees’ Health Insurance Plan (PEEHIP). If you’re a teacher or state employee under this BCBSAL-administered plan, you might have some coverage for fertility treatments, including IUI. IVF coverage isn’t guaranteed, but it’s worth checking your specific PEEHIP policy, as some versions have included limited infertility benefits in the past. Dial up their customer service (1-800-234-3056) and ask about “infertility treatment limits” to get the full scoop.

Real Talk: A Teacher’s Story

Take Sarah, a middle school teacher in Mobile. She and her husband spent months trying to conceive before learning she’d need IVF. As a PEEHIP member, she was thrilled to find her IUI attempts were covered—up to a point. But when it came time for IVF, the plan stopped short. “We had to dip into savings,” she says. “It was tough, but knowing diagnostics were covered gave us a head start.” Sarah’s story isn’t unique—many Alabamians hit this same wall.

Employer Plans: The Hidden Gem of IVF Coverage

Here’s a game-changer: your job might be your ticket to IVF coverage. More companies nationwide are adding fertility benefits to attract and keep employees, and Alabama’s no exception. Big employers—like the University of Alabama at Birmingham (UAB)—sometimes offer plans that include IVF.

Since 2022, UAB employees get a $5,000 lifetime benefit for infertility treatments, including IVF, plus another $5,000 for fertility drugs. It’s not full coverage (a single IVF cycle often tops $10,000), but it’s a huge help. Other large employers, especially those with 500+ workers, might follow suit—45% of them covered IVF in 2023, up from 22% in 2019, according to Mercer’s survey.

How to Check Your Employer’s Plan

Don’t assume your job doesn’t offer this perk. Here’s what to do:

- Grab Your Benefits Handbook: Look for sections on “infertility” or “family-building benefits.”

- Talk to HR: Ask, “Does our plan cover IVF or fertility treatments?” Be ready for a vague answer—push for specifics.

- Compare Plans: If your company offers multiple insurance options, one might include IVF while another doesn’t. Open enrollment is your chance to switch.

Pro tip: If your employer doesn’t cover IVF, ask if they’d consider adding it. With demand rising, some are open to tweaking benefits.

The 2024 Alabama Embryo Ruling: What It Means for Coverage

In February 2024, the Alabama Supreme Court dropped a bombshell: frozen embryos created through IVF are legally “children” under the state’s Wrongful Death of a Minor Act. Clinics freaked out, pausing IVF services over fears of lawsuits if embryos were damaged or discarded. Patients scrambled, some even shipping embryos to Texas.

Fast forward to March 2024—Governor Kay Ivey signed a law shielding IVF providers from legal liability, and services resumed. But here’s the ripple effect: this drama put IVF in the spotlight, sparking chatter about insurance coverage. Could it push Alabama to mandate fertility benefits? Experts say it’s unlikely soon, but it’s got people asking why coverage isn’t standard.

Interactive Quiz: How Much Do You Know About the Ruling?

Take a sec to test your knowledge:

- Question 1: True or False—Alabama now requires all insurance plans to cover IVF because of the 2024 ruling.

(Answer: False. The ruling was about embryo status, not insurance mandates.) - Question 2: What did the new law in March 2024 do?

A) Banned IVF

B) Protected clinics from lawsuits

C) Funded free IVF for all

(Answer: B)

How’d you do? This saga’s a reminder: laws can shift fast, and insurance might follow.

Out-of-State Insurance: A Loophole Worth Exploring

Here’s a little-known trick: if your insurance comes from a state with mandated fertility coverage—like Illinois or New York—you might get IVF covered even if you live in Alabama. How? Some employers offer plans governed by another state’s laws, especially if they’re headquartered elsewhere.

For example, Illinois requires group plans (25+ employees) to cover IVF. If your company’s based in Chicago but you work remotely in Huntsville, your plan might include it. Same goes for federal employees under certain plans—some cover IVF regardless of where you live.

Steps to Investigate Out-of-State Coverage

- Check Your Plan’s Origin: Look at your insurance card or policy docs for the issuing state.

- Research That State’s Laws: Google “[State Name] infertility insurance mandate” to see if IVF’s covered.

- Call Your Insurer: Ask, “Does my plan follow [State Name]’s rules for fertility coverage?”

This isn’t a sure thing, but it’s a goldmine for remote workers or spouses with out-of-state jobs.

Medicaid and Marketplace Plans: What’s the Deal?

If you’re on Alabama Medicaid, don’t hold your breath—fertility treatments like IVF aren’t covered. Medicaid here focuses on basic healthcare, not elective procedures. Same goes for Affordable Care Act (ACA) Marketplace plans in Alabama—they don’t include IVF unless your specific plan adds it as an extra perk (rare).

Compare that to Washington, D.C., where Medicaid covers infertility diagnostics and some treatments as of 2024. Alabama’s lagging behind, but advocates are pushing for change.

Creative Financing When Insurance Falls Short

Let’s say your insurance won’t budge on IVF. You’re not out of options. Alabama clinics and beyond offer ways to ease the sting:

✔️ Clinic Discounts: Places like Alabama Fertility in Birmingham have “shared risk” programs—if IVF fails after a set number of cycles, you get a partial refund.

✔️ Medical Loans: Companies like Future Family offer fertility-specific loans with decent rates—think $10,000 over 5 years at 7% interest.

✔️ Grants: Nonprofits like Baby Quest Foundation give cash to cover IVF costs—apply early, as spots fill fast.

Case Study: The DIY Fundraiser

Meet Jake and Emily from Montgomery. With no IVF coverage, they raised $8,000 through a crowdfunding page, sharing their story on social media. “We were honest about our struggle,” Emily says. “Friends, family—even strangers—chipped in.” Pair that with a clinic discount, and they made it work.

Medications: The Hidden Cost of IVF

IVF drugs—like follicle-stimulating hormones—can tack on $3,000 to $5,000 per cycle. Some plans cover these under a pharmacy benefit, even if IVF itself isn’t included. Check your policy’s drug formulary (a list of covered meds) or call your insurer with this script: “Are fertility medications like Clomid or Gonal-F covered under my plan?”

Mail-order pharmacies (e.g., Alto Pharmacy) often beat local prices and deliver to your door. Bonus: some offer discounts if insurance denies you.

IVF Success Rates in Alabama: Is It Worth the Cost?

Paying out of pocket stings less if you know your odds. Alabama clinics report solid success rates—around 40-50% per cycle for women under 35, per the CDC’s 2021 data. That drops with age, but it’s still competitive nationally. Clinics like the Center for Reproductive Medicine in Mobile boast cutting-edge tech, boosting your chances.

Boost Your Odds: 3 Evidence-Based Tips

- Pick a Top Clinic: Research success rates on the Society for Assisted Reproductive Technology (SART) website.

- Time It Right: Studies show cycles started in spring have slightly higher success (Fertility and Sterility, 2020).

- Stay Healthy: A 2022 study in Human Reproduction linked better outcomes to a Mediterranean diet—load up on fish and veggies!

The Emotional Side: Coping When Coverage Fails

Money’s only half the battle. IVF’s a rollercoaster—hope, heartbreak, repeat. If insurance won’t help, the stress piles on. Support groups (virtual or local, like RESOLVE’s Alabama chapter) can be a lifeline. One mom told me, “Talking to others who get it kept me sane.”

Quick Poll: What’s Your Biggest IVF Worry?

What keeps you up at night? Vote below:

- A) The cost

- B) The process

- C) Whether it’ll work

Drop your pick in the comments—I’m curious!

Future Trends: Could Alabama Mandate IVF Coverage?

Nationwide, fertility coverage is trending up. Twenty-two states plus D.C. have some mandate as of 2025, and pressure’s building elsewhere. In Alabama, the 2024 embryo ruling sparked debate—could it nudge lawmakers toward coverage to “support life”? Don’t bet on it yet, says policy analyst Louise Norris. “It’d take a big shift in politics,” she notes.

Still, public demand’s growing. Social media’s buzzing with calls for equity—why should only the wealthy afford IVF? If that momentum holds, Alabama might surprise us.

Your Action Plan: Making IVF Happen in Alabama

Ready to take charge? Here’s your step-by-step guide:

- Review Your Insurance: Call your provider and ask about infertility benefits—don’t skip this!

- Talk to Your Employer: See if IVF’s on the table or could be added.

- Explore Clinics: Contact local spots like Fertility Institute of North Alabama for payment plans.

- Budget Smart: Mix insurance, loans, or savings to cover gaps.

- Lean on Support: Join a community to stay grounded.

Bonus Checklist: Questions for Your Insurer

✔️ Does my plan cover IVF or IUI?

✔️ Are diagnostic tests included?

✔️ What about fertility meds—any limits?

✔️ Do I need pre-authorization?

✔️ Are out-of-network clinics covered?

Wrapping Up: You’ve Got This

Figuring out what insurance covers IVF in Alabama isn’t a walk in the park, but it’s not impossible either. Whether you’re banking on PEEHIP, an employer perk, or your own hustle, there’s a path forward. Dig into your options, ask the right questions, and don’t be afraid to get creative. Your family-building journey’s worth it—and with a little grit, you’ll get there.

Got a story or tip to share? Drop it below—I’d love to hear how you’re navigating this!