Why Do People Choose IVF? A Deep Dive into the World of In Vitro Fertilization

April 14, 2025

How Much Does IVF Cost in Pennsylvania?

April 14, 2025Will Insurance Pay for IVF After Tubal Ligation?

Will Insurance Pay for IVF After Tubal Ligation?

If you’ve had a tubal ligation—commonly called “getting your tubes tied”—and now find yourself dreaming of growing your family, you’re not alone. Life changes, and so do our plans. Maybe you’ve met a new partner, or perhaps you just feel ready for another child. Whatever the reason, in vitro fertilization (IVF) often comes up as a promising option. But here’s the big question on everyone’s mind: Will insurance cover IVF after a tubal ligation?

The short answer? It’s complicated. Insurance policies vary wildly, and a past tubal ligation can throw a wrench into the mix. Don’t worry, though—this article is your guide through the maze. We’ll break down how insurance works in this situation, what factors affect coverage, and what you can do to maximize your chances of getting help with the costs. Plus, we’ll dive into some fresh angles—like how state laws are evolving and what real families have experienced—that you won’t find in most other articles. Let’s get started.

Why Tubal Ligation Changes the Game

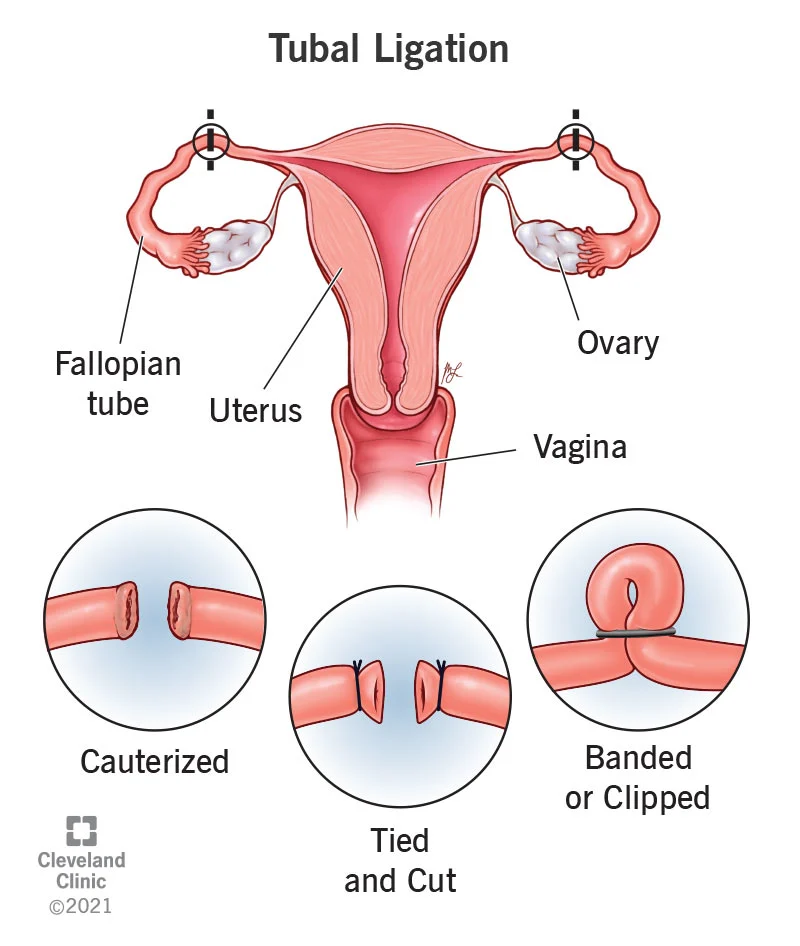

A tubal ligation is a surgical procedure that blocks or cuts the fallopian tubes to prevent pregnancy permanently. It’s a popular choice for women who feel done having kids—about 600,000 women in the U.S. get it done each year. But life isn’t static. Studies suggest that up to 30% of women later regret the decision, and around 1% seek ways to conceive again.

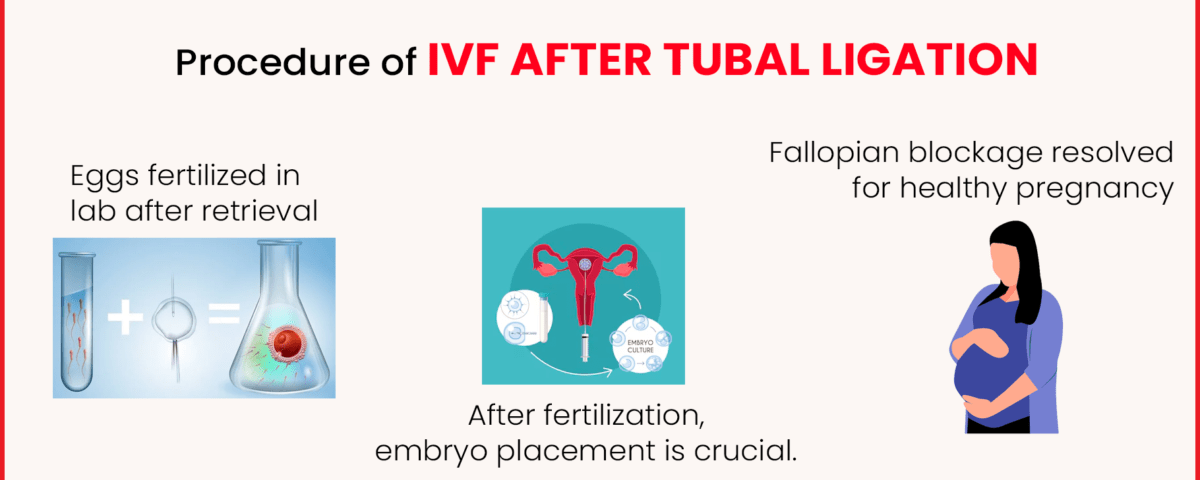

Here’s where IVF comes in. Unlike natural conception, which relies on open fallopian tubes for sperm to meet egg, IVF bypasses the tubes entirely. Doctors retrieve eggs from your ovaries, fertilize them in a lab, and transfer the embryo directly into your uterus. It’s a brilliant workaround—but it’s not cheap. A single IVF cycle can cost between $15,000 and $20,000, and many people need more than one try.

So, why does tubal ligation complicate insurance coverage? Most insurance companies see it as an elective sterilization. If you chose it voluntarily, they often classify any later fertility treatments as “optional” too, not “medically necessary.” It’s like telling your car insurance you dented your bumper on purpose—don’t expect them to pay for the fix. But it’s not always that cut-and-dry, and there are exceptions worth exploring.

How Insurance Companies Decide on IVF Coverage

Insurance isn’t a one-size-fits-all deal. Whether your plan covers IVF after a tubal ligation depends on a handful of key factors. Let’s walk through them.

The “Medically Necessary” Debate

Insurance companies love the phrase “medically necessary.” It’s their golden ticket to decide what they’ll pay for. If your infertility is caused by something like endometriosis or damaged tubes from an infection, they’re more likely to cover IVF. But if you had a tubal ligation by choice, they often say, “You did this to yourself,” and deny coverage for fertility treatments.

Here’s the twist: some states and plans define infertility broadly. For example, if you’ve been trying to conceive for a year (or six months if you’re over 35) without success, you might qualify as “infertile”—even with tied tubes. It’s worth checking your policy’s fine print or calling your provider to ask.

State Laws: Your Secret Weapon

Where you live can make or break your chances. As of April 2025, 21 states in the U.S. have laws mandating some level of infertility coverage. Places like New Jersey, New York, and Rhode Island require insurance plans to cover IVF under certain conditions. But there’s a catch—these mandates often apply only to specific plans (like large employer group plans) and may exclude coverage if your infertility stems from a voluntary procedure like tubal ligation.

For instance, California’s new law, effective July 2025, mandates IVF coverage for large-group plans, offering up to three egg retrievals and unlimited embryo transfers. But if your tubal ligation is seen as elective, you might still be out of luck unless you can prove a medical need beyond the sterilization.

Employer Plans: A Wild Card

If you get insurance through your job, your employer’s choices play a huge role. Big companies like Google, Starbucks, and Microsoft offer generous fertility benefits, sometimes covering IVF regardless of prior sterilization. Smaller businesses? Not so much. Self-insured employers—those who pay claims directly instead of buying a standard plan—are often exempt from state mandates, leaving you at their mercy.

The Tubal Ligation Loophole

Some women have found a workaround: arguing that their tubal ligation wasn’t fully voluntary. Maybe you felt pressured by a doctor or partner, or it was part of a medical procedure (like after a C-section). If you can document this, insurers might reconsider. It’s a long shot, but real stories—like Sarah from Texas, who got coverage after proving her ligation was coerced—show it’s possible.

What the Research Says About Coverage Trends

Let’s dig into some numbers. A 2023 study by the American Society for Reproductive Medicine (ASRM) found that only about 25% of Americans have insurance plans that explicitly cover IVF. Of those, fewer than half extend coverage to cases involving prior sterilization. That leaves a lot of people footing the bill themselves.

But things are shifting. Google Trends data from early 2025 shows a spike in searches for “IVF after tubal ligation cost” and “insurance for IVF after sterilization,” suggesting more people are exploring their options. On X, discussions reveal frustration with insurance denials but also hope as users share success stories of appealing decisions or finding affordable clinics.

One standout trend? Employers are stepping up. A 2024 Mercer survey reported that 42% of large U.S. companies now offer fertility benefits, up from 36% in 2020. Some even cover IVF after tubal ligation as a perk to attract talent. If your workplace doesn’t yet, it might be worth asking HR—they’re under pressure to keep up.

Real Stories: What Families Are Experiencing

Numbers are great, but real life hits different. Meet Emily, a 38-year-old mom from Illinois. After her second child, she had a tubal ligation, thinking her family was complete. Five years later, remarried and longing for another baby, she turned to IVF. Her insurance denied coverage, citing the ligation as elective. Undeterred, Emily appealed with a letter from her doctor explaining her new circumstances. After months of back-and-forth, they approved one cycle—enough for her to welcome a son in 2024.

Then there’s Mark and Lisa from Ohio. Lisa’s tubal ligation was 10 years ago, and their small-business insurance offered zero fertility help. They paid $18,000 out of pocket for IVF, dipping into savings. “It was worth every penny,” Lisa says, cradling their daughter. “But I wish we’d known how to fight the system better.”

These stories highlight a truth: coverage isn’t guaranteed, but persistence (and a little creativity) can pay off.

Interactive Quiz: Will Your Insurance Cover IVF?

Wondering where you stand? Take this quick quiz to get a sense of your odds. Answer yes or no, and tally your points (1 for yes, 0 for no).

- Do you live in a state with an infertility mandate (like NY, NJ, or CA)?

- Does your insurance cover IVF for other infertility causes?

- Is your plan through a large employer (over 100 employees)?

- Can you argue your tubal ligation wasn’t fully elective?

- Have you been diagnosed as infertile despite the ligation?

Score:

- 4-5: Good chance—start digging into your policy!

- 2-3: Maybe—call your insurer to clarify.

- 0-1: Tough road ahead, but don’t give up yet.

This isn’t a promise, just a nudge to investigate further.

Three Under-the-Radar Factors That Could Help

Most articles skim the basics—state laws, policy terms—but there’s more to the story. Here are three angles you won’t find everywhere that could tip the scales.

1. Fertility Preservation Before Ligation

Did you freeze eggs or embryos before your tubal ligation? If so, you’ve got an edge. Some plans cover the use of previously frozen materials, even if they won’t pay for a fresh IVF cycle. It’s rare—only about 5% of women do this, per a 2022 ASRM report—but it’s a game-changer if you’re one of them. Check if your insurance treats this as a separate benefit.

2. Secondary Infertility Diagnosis

Here’s a hidden gem: if you’ve got other fertility issues—like low egg count or a partner with poor sperm quality—those might qualify you for coverage, tubal ligation or not. A 2024 study in Fertility and Sterility found that 15% of women seeking IVF post-ligation had unrelated infertility factors. Get tested; a dual diagnosis could be your ticket in.

3. Appealing with New Laws in Mind

State laws are evolving fast. Even if your plan denied you last year, new mandates (like California’s 2025 rule) might apply now. Insurers hate backtracking, but a well-crafted appeal citing updated regulations can force their hand. Pair it with a doctor’s note, and you’ve got a solid case.

Steps to Maximize Your Coverage Chances

Feeling overwhelmed? Here’s a practical roadmap to navigate the insurance jungle.

Step 1: Know Your Policy Inside Out

Grab your insurance handbook or log into your online portal. Look for terms like “infertility,” “IVF,” and “exclusions.” If it’s gibberish, call customer service—ask specifically about IVF after sterilization.

Step 2: Talk to Your Doctor

Your OB-GYN or fertility specialist can be your MVP. Ask them to write a letter stating why IVF is your best shot (e.g., “Patient has no viable alternative due to tubal ligation”). Medical backing sways insurers.

Step 3: Check State Mandates

Google “[Your state] infertility insurance law 2025.” See if your plan type (HMO, PPO, etc.) falls under the rules. If it does, use that leverage in your appeal.

Step 4: File an Appeal

Denied? Don’t take no for an answer. Submit an appeal with:

- Your doctor’s letter

- Proof of infertility (like failed attempts to conceive)

- Any state law references

Most plans give you 60-180 days to appeal—check your denial letter for deadlines.

Step 5: Explore Employer Benefits

Chat with HR. Even if your base plan excludes IVF, some companies offer add-ons through partners like Progyny or Carrot. It’s a growing trend—worth a shot.

✔️ Pro Tip: Record phone calls with insurers (if legal in your state) to keep a paper trail.

❌ Don’t: Assume a denial is final—60% of appeals win some coverage, per a 2023 insurance study.

Alternatives If Insurance Says No

If coverage isn’t in the cards, you’ve still got options. Let’s explore.

IVF Clinics with Payment Plans

Some fertility clinics—like CNY Fertility—offer IVF for as low as $5,000-$6,000 per cycle, including meds. That’s a third of the national average. They often have financing deals, letting you pay over time. Compare a few clinics near you; prices vary by region.

Tubal Reversal vs. IVF

Another route is reversing your tubal ligation surgically. It costs $5,000-$10,000 on average and isn’t usually covered either. Success rates hover around 40-70%, dropping with age, while IVF boasts 30-50% per cycle for women under 40. A 2023 Fertility and Sterility study found reversal more cost-effective under 41, but IVF wins for speed and reliability. Your call—talk to a specialist.

Grants and Crowdfunding

Nonprofits like Baby Quest Foundation offer IVF grants, sometimes covering half the cost. Crowdfunding sites like GoFundMe are also popular—families raised over $50 million for fertility in 2024 alone, per X chatter. Share your story; people love to help.

Poll: What’s Your Plan?

We’re curious—what’s your next move? Vote below and see what others are thinking!

- A) Appeal my insurance denial

- B) Pay out of pocket for IVF

- C) Look into tubal reversal

- D) Explore grants or financing

(Results show up after 100 votes—check back next week!)

The Emotional Side: Coping with the Cost

Let’s be real—chasing IVF after a tubal ligation isn’t just about money. It’s emotional. The frustration of insurance red tape, the guilt of past choices, the hope of holding a baby—it’s a rollercoaster. One mom, Jenna from Florida, shared on X: “I cried when they denied me, but I kept pushing. Now my twins are two.”

Give yourself grace. Join a support group (online ones are free) or talk to friends who get it. You’re not alone in this.

What’s Next for IVF Coverage?

The future’s looking up. Advocacy groups are pushing for federal infertility mandates, and states like Colorado are eyeing new laws for 2026. Employers, too, are catching on—fertility benefits are the “new 401(k),” says a 2025 HR trend report. If you’re planning IVF in a year or two, your odds might improve.

For now, arm yourself with info. Call your insurer today, even if it’s just to ask, “What’s covered?” Every step gets you closer.

Checklist: Your IVF Action Plan

Ready to roll? Here’s a handy list to kick things off:

- Pull up my insurance policy online or request a copy

- Call my provider—ask about IVF and sterilization exclusions

- Schedule a consult with a fertility doc for a letter

- Research my state’s infertility laws

- Check with HR about extra benefits

- Look up local IVF clinics for cost estimates