How Much Does IVF Cost in North Carolina? Your Complete Guide to Affording Fertility Treatment

April 20, 2025

Is Trump Getting Rid of IVF? The Truth Behind the Headlines

April 21, 2025Is IVF a Tax Deduction? Your Guide to Saving Money on Fertility Treatments

Is IVF a Tax Deduction? Your Guide to Saving Money on Fertility Treatments

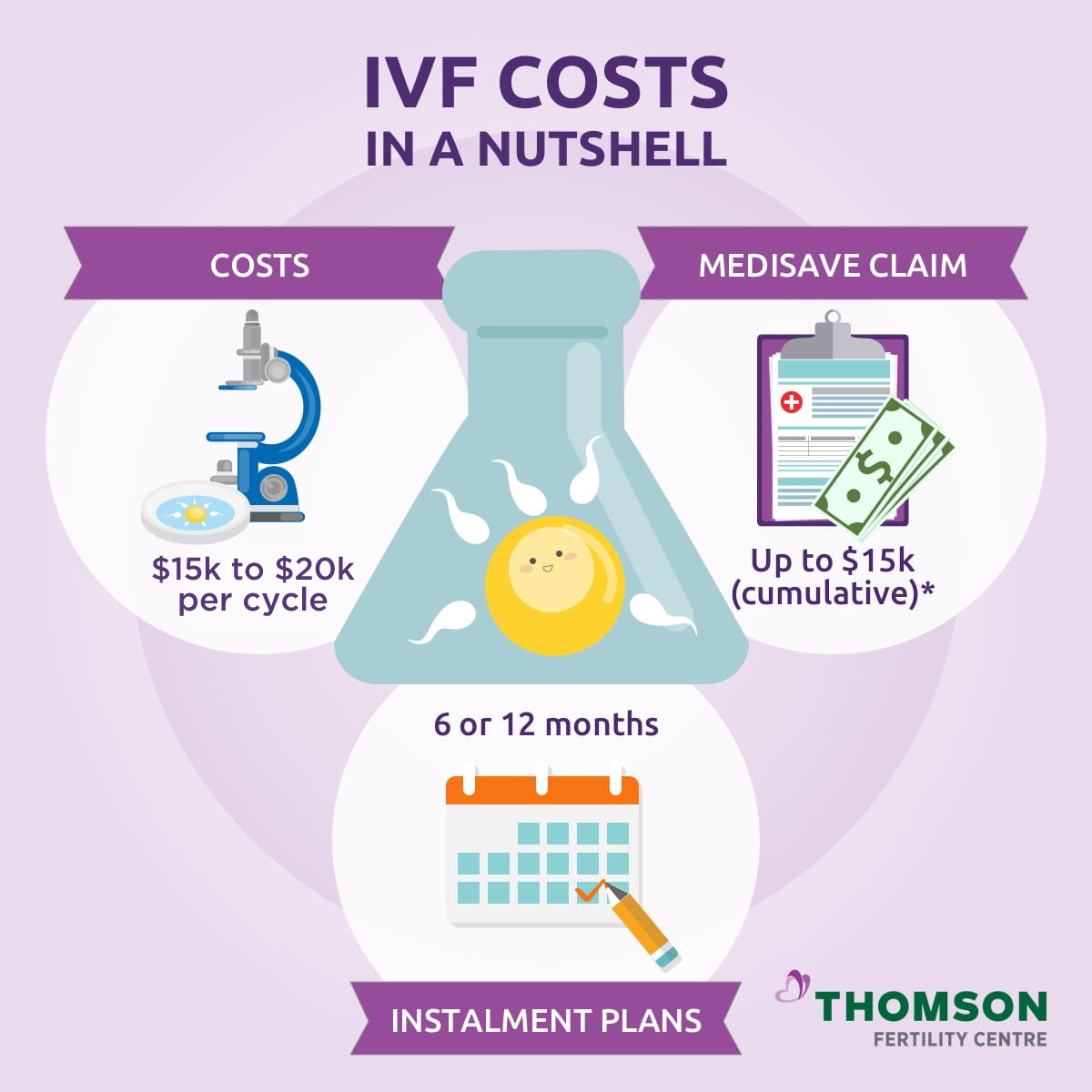

Starting a family can feel like a dream come true, but for many, the journey involves fertility treatments like in vitro fertilization (IVF). If you’ve ever looked at the price tag of IVF—often ranging from $15,000 to $30,000 per cycle—you might be wondering how to make it more affordable. One question that pops up a lot is whether IVF qualifies as a tax deduction. The good news? It often does! But the details can get tricky, and there’s more to it than a simple yes or no.

In this guide, we’ll break down everything you need to know about claiming IVF as a tax deduction in 2025. From what the IRS allows to real-life tips for maximizing your savings, we’ve got you covered. Plus, we’ll dive into some lesser-known angles—like how your marital status might affect your claim, what happens if you use a surrogate, and whether new laws could change the game. Whether you’re knee-deep in fertility treatments or just planning ahead, this article will help you navigate the tax maze with confidence.

Why IVF Costs Add Up—and Why Taxes Matter

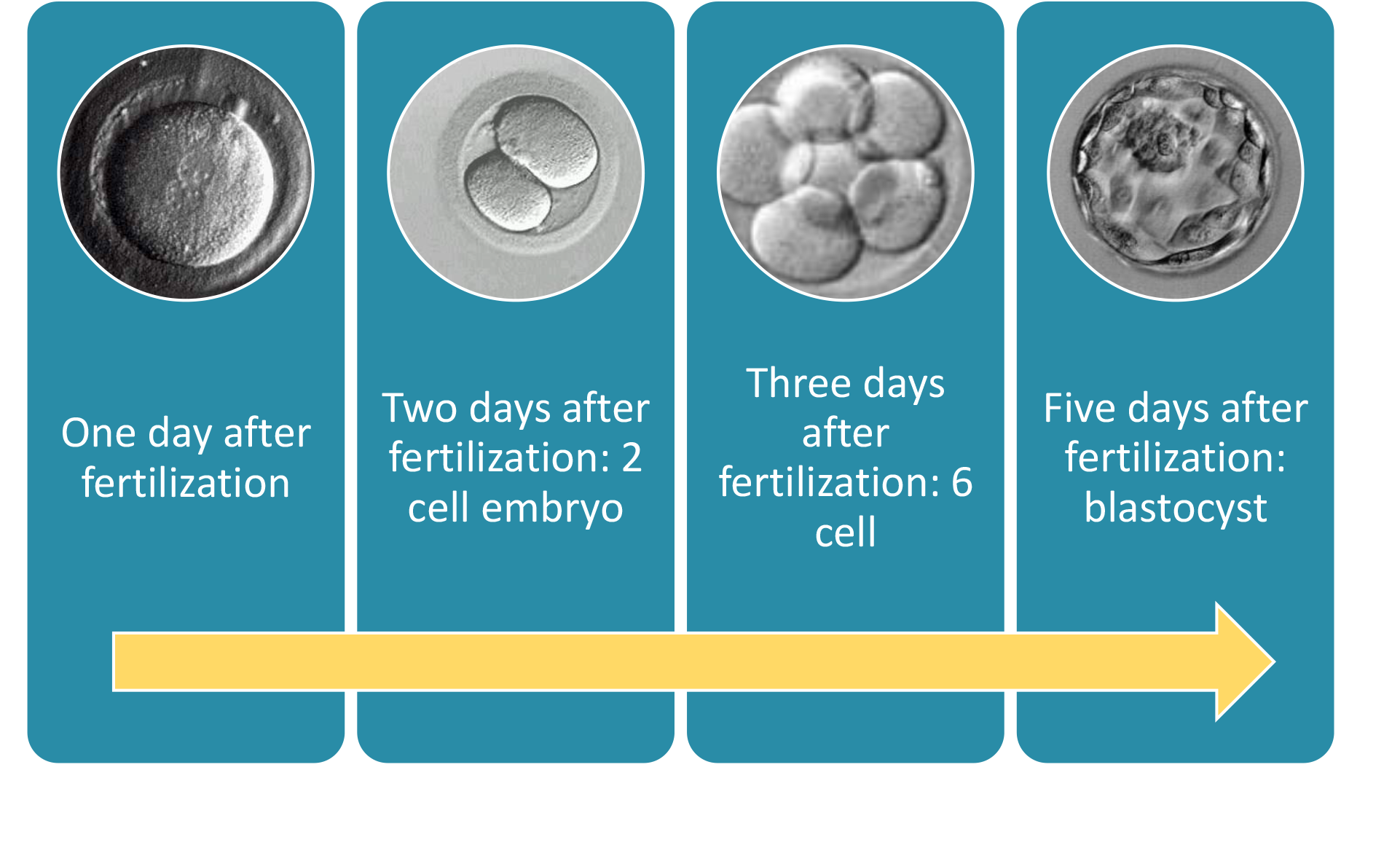

IVF isn’t cheap. A single cycle typically includes medications, egg retrieval, lab fees, and embryo transfers, and that’s before factoring in extras like genetic testing or frozen embryo storage. For many families, it’s not just one cycle—multiple rounds might be needed, pushing costs even higher. According to the American Society for Reproductive Medicine, only about 40% of women under 35 achieve a live birth after one IVF cycle, meaning the rest might need to try again.

That’s where taxes come in. If you can deduct some of these expenses, it’s like getting a discount on your bill. Imagine shaving thousands off your taxable income—it won’t cover everything, but it could free up cash for another cycle or simply ease the financial strain. The trick is knowing what qualifies, how to claim it, and what pitfalls to avoid. Let’s start with the basics.

The IRS Rules: Can You Deduct IVF Costs?

The short answer is yes—IVF expenses can often be deducted as medical expenses under IRS rules. But there’s a catch (isn’t there always?). The IRS only lets you deduct medical costs that exceed 7.5% of your adjusted gross income (AGI). Here’s how it works:

- AGI Basics: Your AGI is your total income (like wages or investments) minus certain adjustments (like student loan interest). Say your AGI is $80,000. Then 7.5% of that is $6,000.

- Deductible Amount: If your total medical expenses—including IVF—hit $20,000, you can deduct the amount over $6,000. That’s $14,000 off your taxable income.

- Itemizing Required: To claim this, you have to itemize deductions on your tax return using Schedule A (Form 1040). If your itemized total doesn’t beat the standard deduction ($14,600 for singles or $29,200 for married couples filing jointly in 2025), it might not be worth it.

So, what IVF costs count? The IRS Publication 502 says “fertility enhancement” expenses qualify if they’re tied to overcoming an inability to have children. That includes:

✔️ Egg retrieval and sperm collection

✔️ Lab fees and embryo transfers

✔️ Medications (like hormone injections)

✔️ Temporary storage of eggs, sperm, or embryos

✔️ Travel costs (like mileage to the clinic) if medically necessary

❌ Cosmetic procedures unrelated to fertility (like elective plastic surgery) don’t count.

❌ General health supplements (unless prescribed by a doctor for IVF) are out too.

Real-world example: Sarah and Tom spent $25,000 on IVF last year. Their AGI was $100,000, so their threshold was $7,500. They deducted $17,500, lowering their taxable income and saving about $4,200 in taxes (assuming a 24% tax bracket). Not a full refund, but a big help!

Who Can Claim IVF Deductions? It’s Not Always Equal

Here’s where things get interesting—and a bit unfair. The IRS ties deductions to a medical need, but how they define it can leave some people out. Married heterosexual couples with a diagnosed infertility condition (like low sperm count or blocked fallopian tubes) have the clearest path to claiming IVF costs. But what about others?

- LGBTQ+ Couples: If you’re a same-sex couple or single, the rules get murky. The IRS has denied deductions for gay men using surrogates, arguing there’s no “medical infertility” if they’re physically fertile. A 2021 ruling allowed some sperm donation costs for a married gay couple, but it’s not a guarantee. Lesbian couples or single women? There’s little precedent, so it’s a gray area.

- Surrogacy Twist: If you use a surrogate, her medical expenses usually don’t count because she’s not you, your spouse, or your dependent. A 2025 IRS private letter ruling (PLR 202505002) confirmed this for a heterosexual couple, though their own sperm donation costs were deductible.

This uneven treatment has sparked debate. Advocates argue it’s outdated, especially as more families use assisted reproduction. A proposed bill, the Equal Access to Reproductive Care Act, aims to level the playing field, but as of April 2025, it’s still in discussion.

Quick Quiz: Does your situation qualify?

- Are you, your spouse, or a dependent getting IVF? (Yes = likely deductible)

- Do you have a diagnosed infertility condition? (Yes = stronger case)

- Are you itemizing deductions? (Yes = you’re on track)

If you’re unsure, a tax pro can help clarify!

Beyond IVF: What Else Can You Deduct?

IVF isn’t the only fertility expense that might cut your taxes. Here’s a rundown of other costs that could qualify, plus some surprises the IRS allows:

- Fertility Medications: Those pricey hormone shots? Deductible if prescribed for IVF.

- Cryopreservation: Freezing eggs or embryos for future use counts, as long as it’s temporary (long-term storage rules are less clear).

- Diagnostic Tests: Bloodwork or ultrasounds to check fertility? Yep, those are in.

- Travel Expenses: Driving to a distant clinic? You can deduct mileage (67 cents per mile in 2025) or lodging if it’s medically necessary. Keep a log with dates and purposes!

- Therapy: Mental health support during IVF—like counseling for stress—can qualify if it’s tied to your treatment.

One overlooked gem: If your employer offers a flexible spending account (FSA) or health savings account (HSA), you can use pre-tax dollars for IVF. It’s not a deduction, but it lowers your taxable income upfront. In 2025, FSA limits are $3,200, and HSA limits are $4,150 for individuals or $8,300 for families.

Case Study: Lisa, a single woman, spent $18,000 on IVF, including $2,000 on travel to a top clinic 200 miles away. Her AGI was $60,000, so her threshold was $4,500. She deducted $13,500, plus $134 in mileage (200 miles x 2 trips x 67 cents). Pairing this with an FSA saved her nearly $5,000 total.

How to Claim IVF Deductions: A Step-by-Step Guide

Ready to file? Don’t wing it—missing a step could cost you. Here’s how to nail it:

- Gather Records: Save every receipt—clinic bills, pharmacy slips, travel logs. Digital copies work, but organize them by date.

- Calculate Your AGI: Check your W-2 or last year’s return. Online tax tools can estimate it too.

- Tally Medical Costs: Add up all qualifying expenses, not just IVF. Doctor visits, prescriptions, even over-the-counter pregnancy tests (if prescribed) count.

- Run the Numbers: Subtract 7.5% of your AGI from your total medical costs. That’s your deduction.

- File with Schedule A: Use IRS Form 1040 and attach Schedule A. List medical expenses under “Other Itemized Deductions” if they don’t fit elsewhere.

- Double-Check: Compare your itemized total to the standard deduction. Only itemize if it’s higher!

Pro Tip: Use tax software like TurboTax or consult a CPA familiar with medical deductions. IVF claims can trigger audits if sloppy, so precision matters.

New Angles: What’s Missing from the Conversation

Most articles stop at the basics, but there’s more to explore. Here are three points you won’t find everywhere:

1. State-Level Boosts

While federal rules dominate, some states sweeten the deal. Colorado mandates IVF coverage for large-group insurance plans, reducing out-of-pocket costs you’d deduct. California covers fertility preservation (like egg freezing) under some plans. Check your state’s tax code too—Arkansas, for instance, offers credits that could stack with federal deductions. These local perks are often overlooked but could save you big.

2. Employer Benefits on the Rise

Big companies like Starbucks ($25,000 per IVF cycle) and Walmart ($20,000 lifetime limit) now offer fertility benefits. If your job covers part of your IVF, only unreimbursed costs are deductible. But here’s the kicker: Smaller firms are joining the trend. A 2024 Mercer survey found 35% of employers with 50+ workers now offer some fertility support, up from 28% in 2020. Ask HR—you might have untapped help.

3. Legislative Winds of Change

Bills like Rep. Miller-Meeks’ IVF Tax Credit (introduced in 2024) propose a $30,000 refundable credit—way better than a deduction since it’s cash back, even if you owe no taxes. It’s not law yet, but momentum’s building. Meanwhile, states like Idaho are floating tax breaks for embryo adoption in IVF. Stay tuned—2025 could bring game-changers.

Common Mistakes to Avoid

Even with the best intentions, it’s easy to slip up. Watch out for these:

❌ Mixing Covered Costs: If insurance or an FSA paid part of your IVF, don’t deduct it. Only unreimbursed expenses count.

❌ Skipping Records: No receipts? No deduction. The IRS loves proof.

❌ Assuming Surrogacy Works: Most surrogacy costs (like agency fees) are off-limits unless you get a rare IRS exception via a Private Letter Ruling.

❌ Forgetting the Threshold: Spending $5,000 on IVF with a $100,000 AGI? You’re under the $7,500 cutoff—no deduction.

Poll: Have you ever missed a tax deduction?

- A) Yep, and it stung!

- B) Nope, I’m a pro.

- C) Not sure—maybe this year!

Share your answer in the comments—we’ve all been there!

Real Savings: Crunching the Numbers

Let’s do a quick experiment. Say you’re a couple with a $120,000 AGI. You spent $30,000 on IVF, $2,000 on meds, and $500 on travel. Total: $32,500. Your threshold is $9,000 (7.5% of $120,000). Deductible amount: $23,500.

- Tax Bracket Impact: At 22%, that’s $5,170 off your tax bill. At 32%, it’s $7,520. Higher earners save more!

- FSA Bonus: Add $3,200 from an FSA, and your savings jump to $5,874 (22%) or $8,544 (32%).

Now imagine stacking a state credit or future federal relief. Suddenly, IVF feels less like a financial mountain.

The Emotional Side: Making It Worth It

Taxes aren’t just numbers—they’re tied to your dreams. IVF is exhausting, physically and emotionally. One study from the Journal of Psychosomatic Obstetrics & Gynecology found 40% of IVF patients report high stress levels, often worsened by money worries. A tax break won’t erase that, but it can lighten the load. Think of it as a small win in a tough journey—a way to reclaim some control.

Checklist: Feeling overwhelmed? Try this:

✔️ Track expenses weekly—it’s less daunting than a year-end scramble.

✔️ Talk to others—support groups often share tax tips.

✔️ Celebrate small victories—even a $1,000 deduction is progress!

Looking Ahead: What’s Next for IVF and Taxes?

As of April 2025, the landscape’s shifting. Birth rates are dropping (1.6 kids per woman in the U.S., per the CDC), and demand for IVF is up—over 90,000 babies were born via IVF in 2022, the latest data shows. Lawmakers are noticing. If the IVF Tax Credit passes, it could flip the script, offering refunds over deductions. Even without it, growing awareness means more employers and states might step up.

For now, focus on what you can control: max out deductions, explore benefits, and keep an eye on policy updates. You’re not just building a family—you’re building a strategy.